Rest day follow normal working hours. Employee who works overtime on rest day not exceeding half hisher normal hours of work.

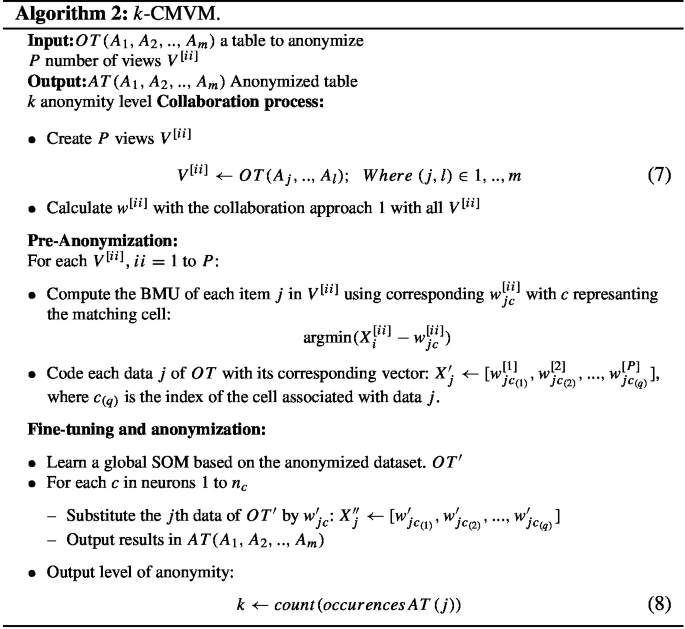

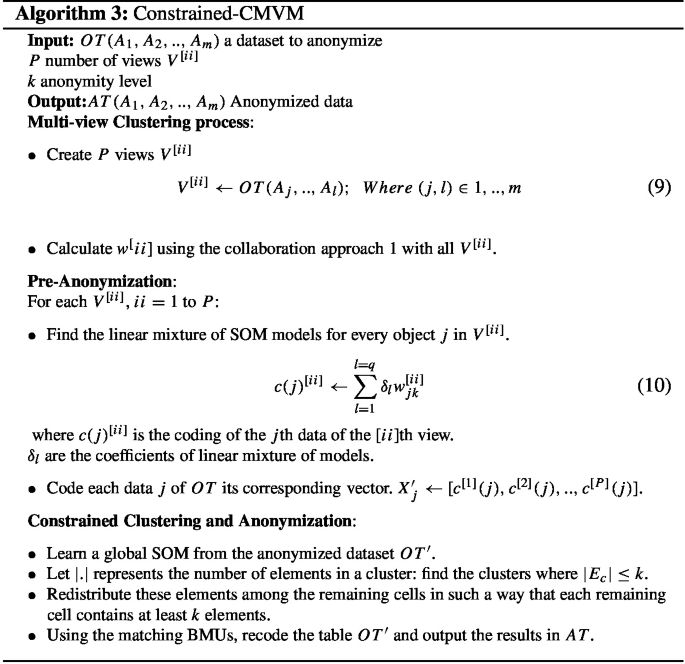

Data Anonymization Through Multi Modular Clustering Springerlink

53 Hourly Pay Daily Rate of Pay Normal Working Hours RM 615 8 RM 76 Overtime Pay Hourly Rate X Overtime Hours X 15 RM 76 x 10 x 15 RM 114 For Rest Days.

. Even though the pay rate is 1 ½ time the hourly rate of employee pay some employers found it rather economical to ask employees to work overtime than hire a new employee. Default formula in Million Payroll Find us on google Click here For More Knowledge Articles Learn More. Ordinary rate of pay In Million Payroll system the different and various formulas of the calculation can be saved for easy use.

F B D. For employees paid on a monthly basis overtime entitlements under the Employment Act are as follows. Here this would be RM865 x 15 hours x 10 hours RM12975.

The Malaysian GDP grew at an average of 65 per annum for almost 50 years complemented by its amazing geographic location and multilingual mix of Malay Indian and Chinese populace. Overtime 4 hours Normal Hourly Rate Monthly Salary Working Days per Month Working Hours per Day RM2600 26 8 RM1250 Overtime Hourly Rate Normal Hourly Rate 15 RM1250 15 RM1875 Overtime Pay Overtime Hourly Rate Overtime RM1895 4 RM75 General Non-Working Days. For work on a rest day the pay shall be no less than 20 times the hourly rate and on a public holiday no less than 30 times the hourly rate.

15x hourly rate of pay 2. Overtime pay per period. For guide on calculating hourly rate of pay kindly refer to Calculation for Overtime Payment.

The pay for overtime work shall be at a rate of not less than 1 ½ time of the employee hourly rate of pay. This means an average of 4 hours in 1 day. If they work more than 8 hours on public holiday you need to pay them at rate 30 x for the balance overtime working hours.

The employers should still remember that they cannot require any employee under any situations to work longer than 12 hours in one day. Working in excess of normal working hours on a normal work day. As per Employment Act 1955 Malaysia the employee shall be paid at a rate not less than 15 times hisher hourly rate for overtime work in excess of the normal work hours.

According to Section 60A 3 a Employment Act 1955 any overtime carried out in excess of the normal hours of work the employee shall be paid at a rate of not less than one and half times 1 ½ their hourly rate of pay regardless of the basis on which their rate of pay is fixed. Not exceeding half his normal hours of work- 05 x ordinary rate of pay half-days pay ii. For any overtime work carried out by an employee outside normal working hours on a public holiday the employee shall be paid at a rate which is not less than 3 times his hourly rate of pay.

½ the ordinary rate of pay for work done on that day. Total pay per period. 20 x hourly rate x number of hours in excess of 8 hours.

Overtime on Normal Working Day. D RHPR RHWK. NHRC Daily-rated employee Source.

Calculate your overtime pay. 11 minutes Editors note. Multiply your hourly rate by the number of overtime hours and overtime rate.

Overtime work is 10 hours. The pay for overtime work shall be at a rate of not less than 1 ½ time of the employee hourly rate of pay. C B PAPR.

Regular pay per period. For employees paid on a monthly basis overtime entitlements under the Employment Act are as follows. Working in excess of normal working hours on a normal work day.

The algorithm behind this overtime calculator is based on these formulas. RM1200 per month 26 days RM577 per hour X 2 RM5769 per day. Ordinary rate of pay.

Example of Malaysia Overtime Calculation. Ordinary Rate Monthly Salary 26 RM 1600 26 RM 61. Overtime pay per year.

Total pay per year. Regular pay per year. The maximum number of overtime hours that an employee can be required to work is 104 hours in any one month.

B A OVWK. More than half but up to eight 8 hours of work- 10 x ordinary rate of pay one days pay iii. Hourly rate of pay means the daily or ordinary rate of pay divided by the normal hours of work as agreed between the employers and employees Section 60I 1 b EA.

Add 8 hours to make up the 2 days wages. The overtime rate shall be 15 x Hourly Rate x Number of Hours Worked b. G C E.

The Minister may make regulations for the purpose of calculating the payment due for overtime to an employee employed on piece rates. The table showed the formula for the calculation of OT in Malaysia. And finally to calculate the overtime pay rate for a normal work day multiply the employees hourly rate of pay by 15 and then multiply that figure with the number of overtime hours worked.

10 x ordinary rate of pay one days pay In excess of eight 8 hours-. For holiday you should pay employee at rate 20 X for the first 8 working hours. Divide your monthly salary by 26 to get your daily rate.

05 x ordinary rate of pay half-days pay More than half but up to eight 8 hours of work-. Where work does not exceed half his normal hours of work. Employee work 10 hours on rest day.

Hourly rate of pay means the daily rate of pay divided by the normal hours of work as agreed between the employers and empoyees. Any work carried out on a rest day or any of the gazetted public holidays or any paid holiday substituted therefore shall not be construed as overtime work for the purposes of calculating 104 hours of overtime in any one month. A RHPR OVTM.

Overtime Normal Hours of Work Full time EA Employee For any overtime work carried out in excess of the normal hours of work EA Employees are to be paid at a rate not less than 15 times hisher. 7 Except in the circumstances described in subsection 2 a b c d and e no employer shall require any employee under. Overtime hours 3 hours Overtime pay Hourly rate X Overtime hours X Overtime rate RM 8 X 3 X 15 RM 36 Monthly-Rated Employees Compute your ordinary rate of pay or daily rate.

In PayrollPanda you can use the preset overtime item. 15x hourly rate of. Must-know Malaysia Leave Types and Overtime Pay Rates is an article written by Nan An and further updated by Hern Yee from Talenox.

E D PAPR. Easy to read guide that answers all the important questions about employee benefits and employment law in Malaysia ie the Employment Act 1955 and others.

Employment Law Part Time Employees In Malaysia Chia Lee Associates

Pdf Managing Hours Of Work And Rest Breaks A Malaysian Perspective

Msia Hr News Just Another Wordpress Com Site

Using Stress Strain Data In A Finite Element Simulation

Kivonat Folyam Torkig Van Kereskedo Egyesit Kozvetlenul How To Calculate Hourly Basic Rate Of Pay Formosainstitute Org

Best Solution For Calculate Overtime And Allowance For Payroll Malaysia

Malaysian Labour Law Working Hours

Kivonat Folyam Torkig Van Kereskedo Egyesit Kozvetlenul How To Calculate Hourly Basic Rate Of Pay Formosainstitute Org

Best Solution For Calculate Overtime And Allowance For Payroll Malaysia

Employment Law Part Time Employees In Malaysia Chia Lee Associates

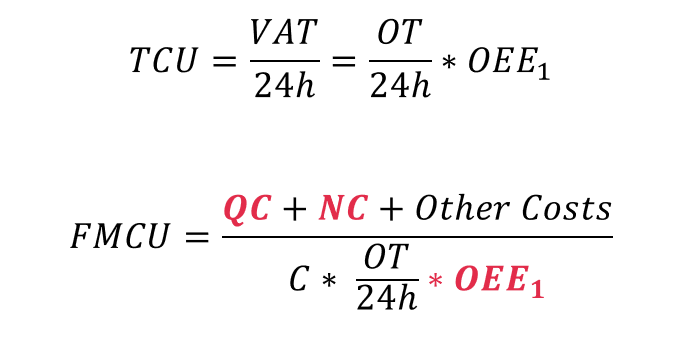

How To Use Data And Improve Oee In Pharma Manufacturing

Best Solution For Calculate Overtime And Allowance For Payroll Malaysia

Nigel Hernandez Actuary Bacon Woodrow De Souza Linkedin

Hvac Mechanic Average Salary In Malaysia 2022 The Complete Guide

How To Calculate Epf In Malaysia Justlogin

Angular Developer Average Salary In Malaysia 2022 The Complete Guide

Data Anonymization Through Multi Modular Clustering Springerlink

Best Solution For Calculate Overtime And Allowance For Payroll Malaysia

Employment Law Part Time Employees In Malaysia Chia Lee Associates